U.S. Treasury Yields Remain Steady as Markets Eye Trump's Latest Tariff Moves

On Tuesday, U.S. Treasury yields showed little movement as investors digest President Donald Trump's recent announcement of sweeping new tariffs on imports from 14 countries, including key U.S. allies. The cautious market sentiment reflects uncertainty around how these trade measures will ripple through global supply chains and impact economic growth.

Current Yield Levels

- 10-year Treasury yield: modestly up 1 basis point, settling at 4.407%

- 30-year Treasury yield: unchanged at 4.93%

- 2-year Treasury yield: steady at 3.903%

For context, one basis point equals 0.01%. Given the inverse relationship between bond yields and prices, this stability indicates a wait-and-see approach among investors amidst fresh trade policy uncertainties.

The Tariff Announcement and Its Implications

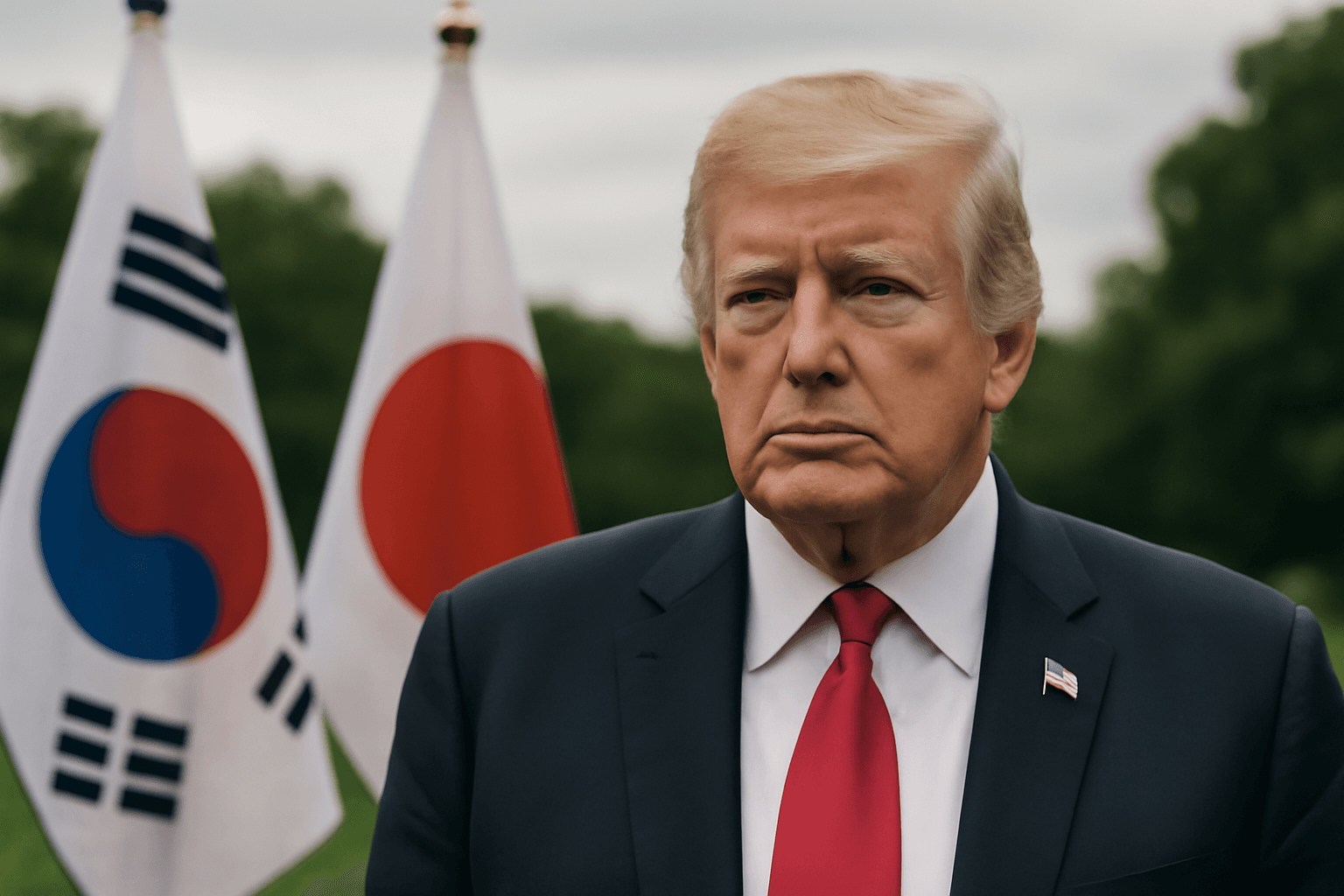

On Monday, President Trump unveiled a series of letters on social media directed at the heads of state from 14 countries, announcing that starting August 1, import tariffs would be significantly raised. The countries targeted span Asia, Africa, and eastern Europe, including Japan, South Korea, Malaysia, Kazakhstan, South Africa, Laos, Myanmar, Bosnia and Herzegovina, Tunisia, Indonesia, Bangladesh, Serbia, Cambodia, and Thailand.

A notable spotlight falls on Japan, where the tariff will increase to 25%, up from 24% initially declared in April. This increment signals a continuing hardening stance in U.S. trade policy despite earlier indications that the August 1 deadline might be flexible.

On Tuesday, President Trump shifted from his previous ambiguous tone and confirmed there would be no extension or changes to the August 1 deadline. This hardline approach has injected fresh volatility into markets, with additional steep tariffs announced later that day further ratcheting up tensions.

Market and Economic Expert Perspectives

While the administration remains open to negotiations, the looming threat of higher tariffs has resulted in increasing unease among investors and economists alike. David Kohl, chief economist at Julius Baer, warns that these trade tensions could curb U.S. investment sentiment and amplify inflationary pressures by driving up costs.

Moreover, Kohl highlights a growing risk of stagflation—a challenging economic condition characterized by slow growth and rising inflation—stemming from disrupted trade flows and uncertainty. This condition, he argues, pressures not only the U.S. economy but also prompts Europe to ramp up domestic demand initiatives to counterbalance faltering international trade.

Broader Context and Unseen Narratives

The renewed tariff threats arrive at a time when global markets are still navigating post-pandemic recovery challenges, supply chain realignments, and geopolitical tensions. Although tariffs are intended to protect domestic industries, they often lead to higher consumer prices and strained international relations.

Beyond the economic numbers lies a strategic question: how sustainable is this approach to trade policy in an interconnected global economy? Analysts and policymakers must weigh immediate political gains against long-term economic stability, as well as the potential backlash from allies critical to the U.S.'s geopolitical interests.

Looking Ahead

As the August 1 deadline approaches, market participants will keenly watch for any shifts in trade policy or diplomatic negotiations that could ease tensions. The interplay between tariffs, inflation, and bond yields will remain a crucial barometer for the broader economic trajectory.

Key Takeaways:

- U.S. Treasury yields remain steady but are shadowed by tariff-induced uncertainty.

- New tariffs on 14 countries escalate U.S. trade tensions, especially with allies.

- Economic experts caution against rising stagflation risks amid ongoing policy volatility.

- Long-term implications hinge on diplomatic negotiations and global economic responses.

Editor’s Note

The unfolding trade developments underscore the delicate balance policymakers face between protecting domestic interests and maintaining global economic harmony. While tariffs may offer short-term advantages to certain sectors, they also risk amplifying inflationary pressures and dampening investment. Readers should remain vigilant about how these trade dynamics could influence inflation, market stability, and everyday costs in the months ahead.