The EU’s Bold Move in Trade Tensions with the U.S.

As tensions escalate over trade between the European Union and the United States, the EU is reportedly preparing to unleash a powerful but largely untested tool designed to counteract economic pressures: the Anti-Coercion Instrument (ACI). This mechanism could come into play as the U.S. government threatens to impose a 30% tariff on EU imports starting August 1, 2025, if a trade agreement is not finalized by then.

Understanding the Anti-Coercion Instrument

Introduced in 2023, the ACI is often referred to as the EU’s “trade bazooka,” a last-resort strategy designed to respond to what Brussels perceives as coercive economic tactics by third countries. It allows the EU to impose a range of countermeasures including:

- Restrictions on imports and exports of goods and services

- Limitations on foreign direct investments

- Excluding foreign suppliers from public procurement tenders

- Sanctions on intellectual property rights

The primary goal of the instrument is deterrence — to discourage unilateral economic pressure or intimidation. However, if coercive actions persist, the EU can respond proportionately to protect its economic interests.

How the ACI Plays Out in Practice

Deploying the ACI is not a swift or unilateral decision. The European Commission must first thoroughly investigate any alleged coercion, then seek confirmation from member states, requiring a qualified majority. This multistep process ensures measured and collective EU action. Furthermore, the EU often prioritizes dialogue before engaging the instrument outright, emphasizing diplomacy alongside economic defense.

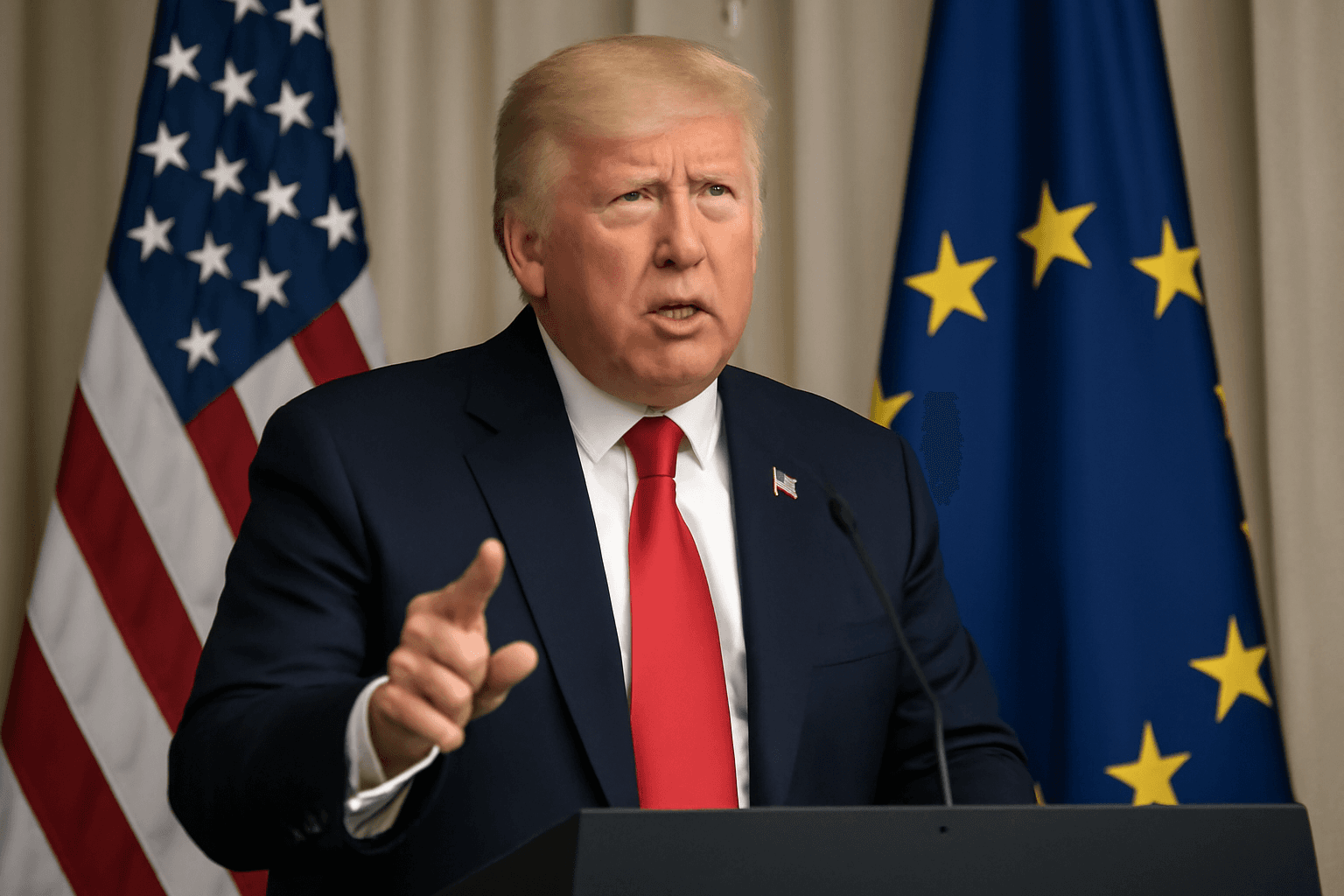

Context: Trade Frictions Under the Trump Administration

Relations between the EU and the U.S. have been strained, particularly under former President Donald Trump’s administration — which criticized the EU for what it considers unfair trading practices due to a persistent goods trade surplus. In 2024, trade between the two was valued at approximately €1.68 trillion ($1.97 trillion), with the EU holding a surplus in goods but a deficit in services.

Trump's looming tariff threat seeks to leverage this imbalance, imposing a significant 30% tariff increase on EU imports if a deal remains elusive. In response, several EU countries, including economic heavyweights Germany and France, signal readiness to enact retaliatory measures, potentially activating the ACI.

Potential Impacts and Stakes for Key Industries

The EU aims to negotiate a trade deal involving a more moderate baseline tariff of around 10%, sparing crucial sectors such as automotive, agriculture, machinery, and aerospace. However, if the U.S. sticks to its aggressive stance, the ACI enables Brussels to introduce:

- Counter-tariffs targeting U.S. exports worth up to €116 billion

- Restrictions on American companies’ participation in EU public tenders

- Limitations affecting U.S. service sectors where the U.S. enjoys a surplus (e.g., digital services, chemicals, and food supply chains)

These measures could ripple through global supply chains, impacting millions of workers and consumers on both sides of the Atlantic.

Expert Insight: A Delicate Balance

Mujtaba Rahman and colleagues from Eurasia Group characterize the ACI deployment as a strategic “trade bazooka” reserved as a final step to counter unyielding pressure. They emphasize that while some EU members push for tough retaliation, the European Commission might first pursue tariff adjustments before escalating to broader trade restrictions and investment curbs.

Legal experts note that the ACI reflects growing EU ambition to assert economic sovereignty amid a shifting global trade environment, especially as U.S. trade policies under Trump have signaled increased protectionism.

Broader Implications: What This Means for Transatlantic Relations

The unfolding dynamics underline a precarious moment in EU-U.S. relations. Beyond immediate trade consequences, the dispute raises bigger questions about the future of global trade governance, multilateral cooperation, and economic diplomacy:

- Can the EU effectively balance deterrence and dialogue to avoid an all-out trade war?

- How will American businesses adjust to potential EU restrictions?

- What are the implications for international trade rules and institutions like the WTO?

As the August 1 deadline nears, market watchers and policymakers alike watch closely for signs of compromise or escalation — with real consequences for global economic stability.

Editor’s Note

The emergence of the EU’s Anti-Coercion Instrument signals a new era where economic power plays are met with swift, coordinated defense strategies. While it remains to be seen whether the ACI will be triggered amid current U.S.-EU tensions, its development highlights Europe's evolving approach to safeguarding trade interests amid geopolitical uncertainty. This story exemplifies how trade policy is no longer just about economics but reflects broader struggles over influence, sovereignty, and diplomatic posture on the world stage.

Readers are encouraged to consider: How might such trade instruments reshape global trade relations in the coming years? And, importantly, what roles do diplomacy and engagement still have in resolving disputes that impact millions?