Europe Braces for Possible No-Deal Trade Fallout with the U.S.

As global trade tensions simmer, the European Union is gearing up for a potential no-deal scenario with the United States amid ongoing tariff disputes. Despite fresh talks hinting at a potential agreement, deep uncertainties persist over whether U.S. tariffs on EU goods—scheduled to rise to 30% after August 1, 2025—will be avoided or inevitably trigger retaliatory measures from Brussels.

The High Stakes of EU-U.S. Trade Relations

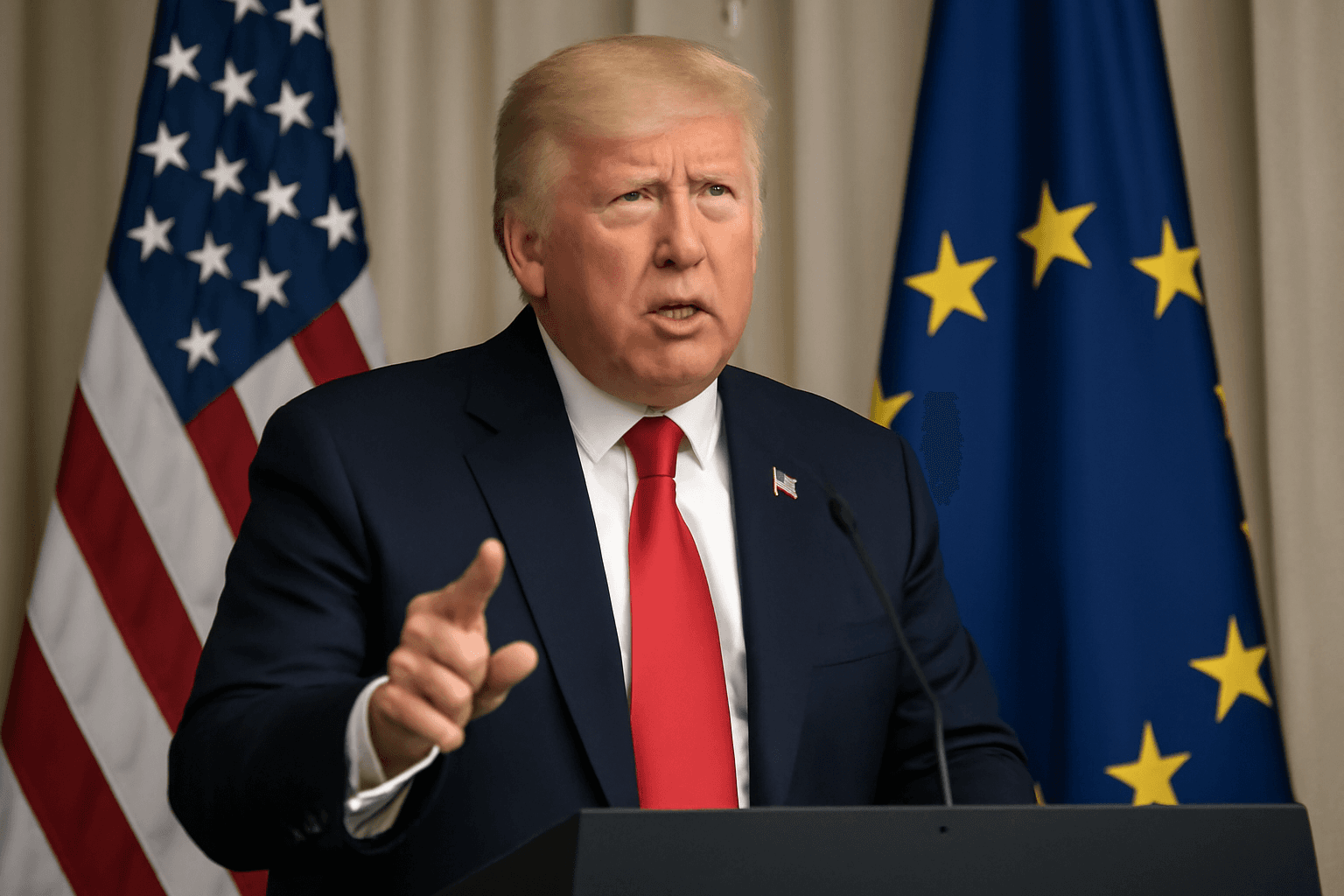

Negotiations between the EU and U.S. have extended well beyond the typical political timelines, fueled by President Donald Trump's unpredictable stance and swift decision-making style. The current tentative groundwork suggests a possible compromise involving a reduced 15% tariff on EU exports to the U.S., although any exemptions are still under intense discussion behind closed doors.

Given the volatility of U.S. trade policy, European policymakers have concluded that prudent preparedness is essential. As such, this week the European Parliament approved a sweeping package of countermeasures aimed at offsetting the potential impacts of American tariffs.

Retaliatory Tariffs: An Extensive Arsenal

The EU’s response is poised to cover an extensive array of goods valued at approximately €93 billion (around $109 billion). These measures would encompass key sectors such as food and beverages, apparel, machinery, and luxury goods – effectively mirroring the U.S. tariffs’ scope and potentially hitting industries known for significant transatlantic trade.

Carsten Brzeski, ING’s global head of macro, remarked on this tit-for-tat strategy: “We anticipate the EU imposing sharp 30% tariffs on targeted U.S. imports like motorcycles, cars, clothing, and alcohol. However, given divergent views within EU member states, a calibrated approach aiming to match rather than escalate U.S. tariffs is more likely.”

The EU’s ‘Trade Bazooka’: Anti-Coercion Instrument

Beyond tariffs, the European Commission has at its disposal the so-called Anti-Coercion Instrument (ACI), nicknamed the “trade bazooka.” This tool is designed to defend the EU’s economic sovereignty against coercive measures by third countries that undermine or threaten its trade and investment framework.

The ACI is multifaceted, enabling the EU to formally identify and respond to economic coercion, with options ranging from imposing import and export restrictions to curbing access to the EU market itself. Importantly, the Commission emphasizes that the ideal scenario is never to have to deploy the ACI—it's a deterrent intended to preserve strategic leverage rather than provoke escalation.

Policy expert Alberto Rizzi from the European Council on Foreign Relations explained, “While the ACI may seem like the ‘nuclear option,’ its real-world application is nuanced and flexible. The EU aims for proportionality in retaliation, balancing assertiveness with diplomatic channels.”

Rizzi added that the ACI is expected to be reserved for a potential second phase of escalation—activated only if initial tariff counteractions fail to prompt a constructive U.S. response.

Broader Implications for Transatlantic Trade

The unfolding EU-U.S. tariff standoff raises profound questions about the future structure of transatlantic economic relations. Experts warn that prolonged tariff battles could ripple across global supply chains, disrupt industries reliant on integrated markets, and exacerbate inflationary pressures at a time when economic recovery remains fragile in many regions.

From a U.S. policy perspective, the tariffs reflect an ongoing strategic approach aiming to protect domestic industries but risk alienating key trade partners. For the EU, grappling with internal consensus while maintaining a unified front adds complexity to responding effectively to external shocks.

- Potential winners and losers: Exporters in both the EU and U.S. stand to lose market share, while import-dependent companies may face higher input costs.

- Global supply chains: Companies may begin rerouting production to avoid punitive tariffs, reshaping manufacturing hubs.

- Policy precedent: The effectiveness and ramifications of the ACI could influence future EU trade defense policies.

Looking Ahead: Negotiations and Risks

With just days available before the U.S. tariff increase deadline, diplomacy remains intense but fragile. Stakeholders worldwide are watching closely, aware that the final outcome will shape not only EU-U.S. relations but also set benchmarks for global trade governance in an era increasingly marked by protectionism and geopolitical competition.

For American policymakers and businesses, understanding the EU’s prepared countermeasures offers critical insight. The stakes transcend mere economics, touching on geopolitical stability and the very principles of multilateral trade.

Editor’s Note

The evolving trade tussle between the EU and the U.S. is emblematic of wider shifts in global economic power dynamics and governance norms. As Europe positions itself with both measured retaliation and strategic restraint, critical questions arise: Can pragmatic diplomacy prevail over escalating protectionism? Will tools like the Anti-Coercion Instrument set a new standard in trade defense without fragmenting global markets? And fundamentally, how will businesses and consumers on both sides adjust to a new normal of regulatory uncertainty?

For now, the backdrop is one of cautious vigilance—where every tariff decision carries potential ripple effects that go far beyond customs borders.