A Rose-Tinted Economic Survey Masks Ground Realities

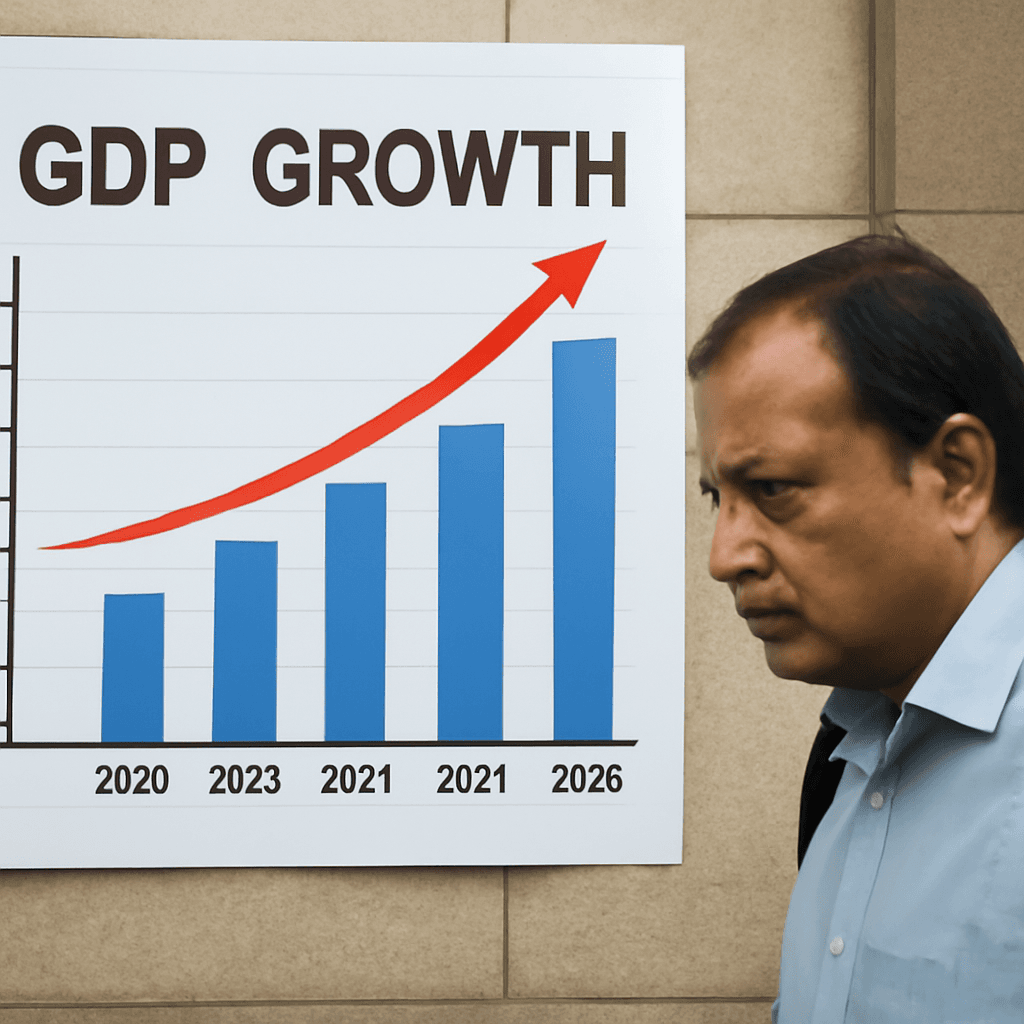

Ahead of the federal budget announcement, the government unveiled Pakistan’s Economic Survey 2024-25, painting a cautiously optimistic picture of the nation’s finances. Presented by Finance Minister Muhammad Aurangzeb, the report highlights a projected GDP growth of 2.7% for 2025, marking a slight improvement from 2.5% in 2024 and a rebound from the 0.2% contraction in 2023. Yet, beneath these optimistic figures lies a stark contrast to the everyday experiences of millions of Pakistanis.

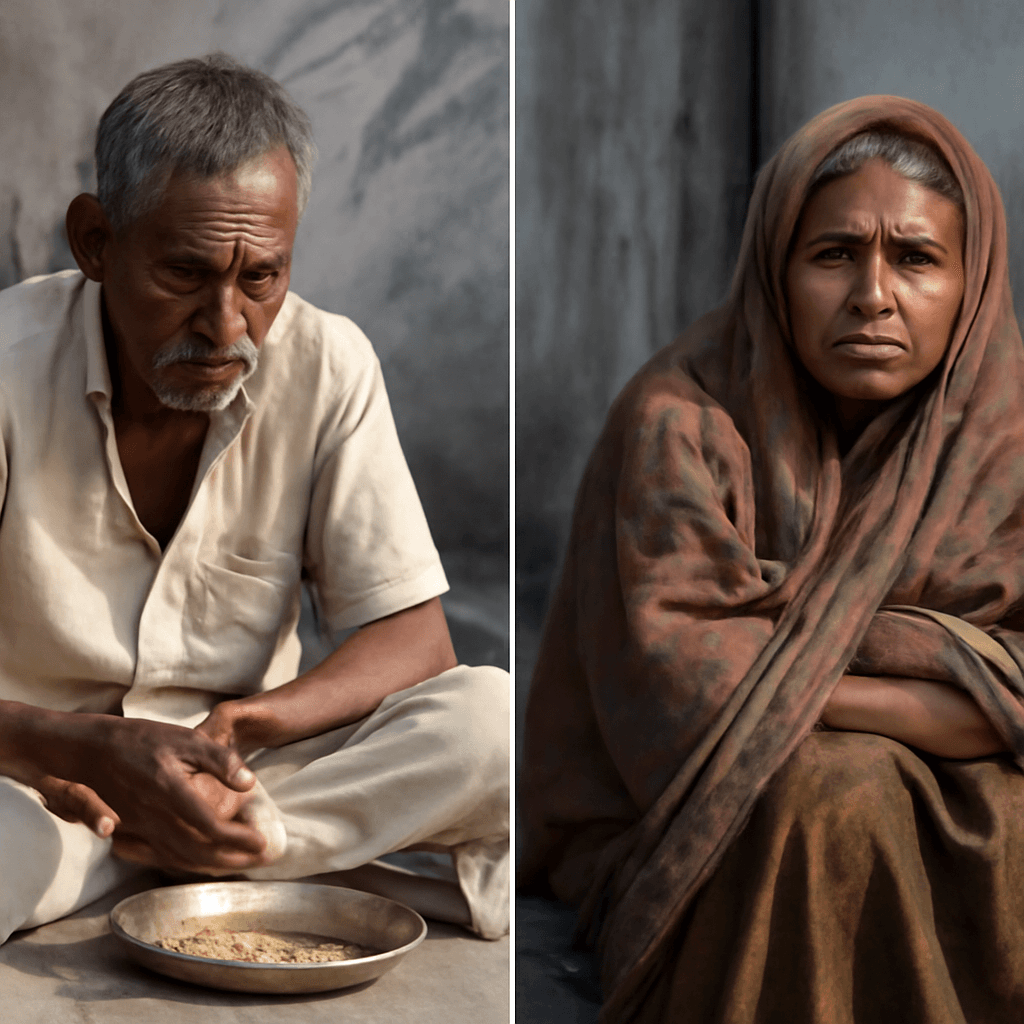

Modest Growth Does Not Alleviate Widespread Struggles

While officials describe the economy as being on a “gradual path to recovery,” the growth rate remains inadequate for a country exceeding 240 million people, still grappling with soaring inflation, chronic food insecurity, and lackluster job creation. The official numbers, critics argue, serve more as an attempt to sidestep deep-rooted structural problems rather than reflect tangible progress.

Inflation: Statistical Relief or Illusion?

The survey reports a decline in inflation to 4.6%, a significant drop from recent double-digit rates. In reality, however, soaring prices of essential goods like food, fuel, and electricity continue to burden households nationwide, making the reported figure questionable. For many, inflation remains an unrelenting challenge rather than a fading threat.

Interest Rate Cuts: Temporary Breather, Not a Victory

The reduction of interest rates from 22% to 11% might appear promising at first glance. Yet, this rollback follows a period of prohibitively high borrowing costs, largely attributed to fiscal mismanagement. Rather than marking triumph, it’s better understood as a necessary recalibration amid economic strain.

Exports and Remittances: A Mixed Bag

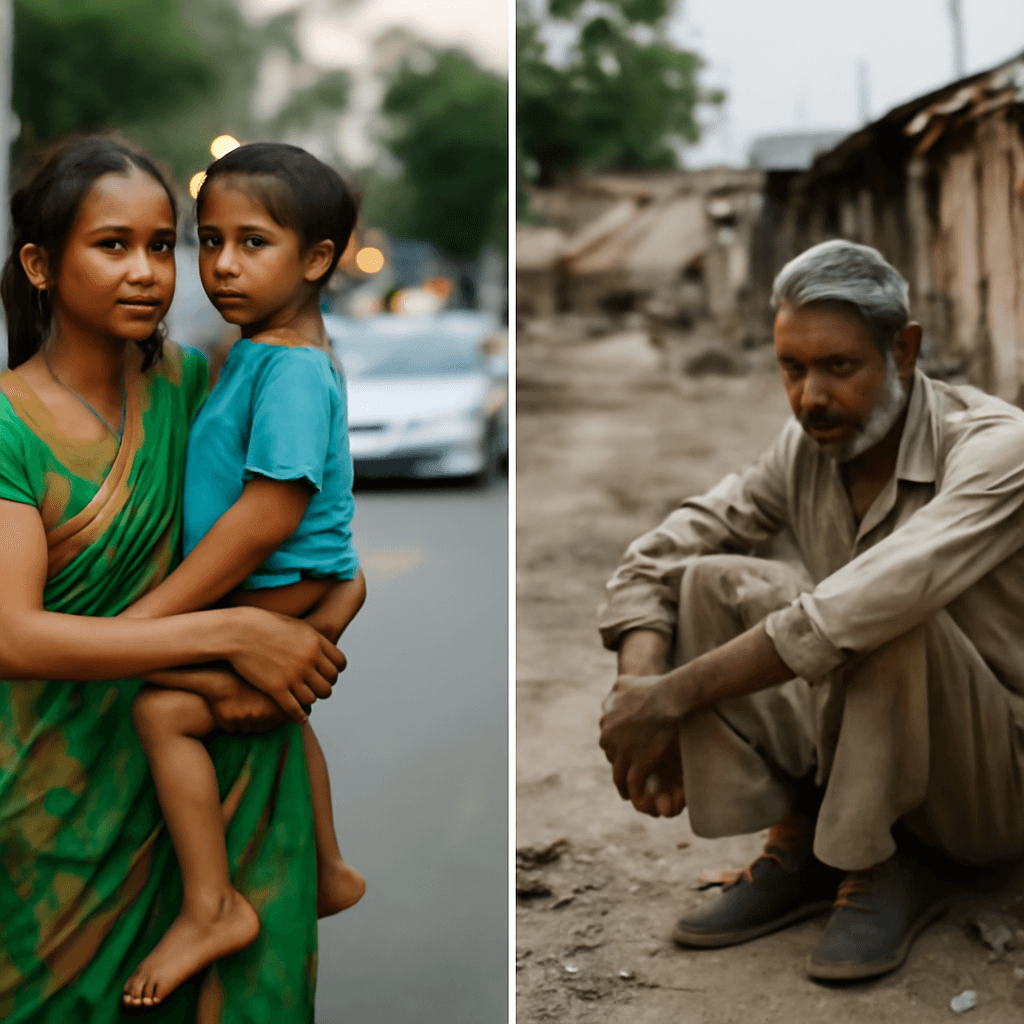

Exports inched up by 7%, with IT services contributing around $3.1 billion, including $400 million from freelancers. Despite these gains, remittances have taken center stage, soaring to approximately $38 billion this year — a remarkable $10 billion increase over two years. Yet this surge reflects growing reliance on the diaspora’s support rather than domestic economic resilience.

Experts warn that Pakistan is essentially dependent on overseas workers’ remittances to sustain its economy, outsourcing survival to families abroad rather than cultivating robust internal growth.

Fiscal Realities: Surplus Amid Constraints and Inequality

The survey’s claim of a $1.9 billion current account surplus raises eyebrows. This surplus owes more to controlled imports, currency restrictions, and deferred payments than to healthy trade or investment flows. Furthermore, a declared 26% rise in revenue collection barely scratches the surface of deep fiscal imbalance.

Indirect taxes continue to weigh heavily on ordinary citizens, while powerful vested interests — including military-run enterprises, influential landlords, and politically connected elites — largely avoid tax responsibilities, skewing the system further.

Looking Ahead: IMF Conditions and Budget Expectations

With the federal budget poised for release, skepticism remains high. Early indications suggest the fiscal plan aligns closely with International Monetary Fund (IMF) requirements, featuring austerity measures and privatization efforts that prioritize external conditions over easing domestic hardships.

Despite official claims of recovery, widespread issues persist: fuel and food prices remain prohibitive, youth unemployment is high, and investor confidence is fragile. For many Pakistanis, survival amid economic uncertainty continues unabated, casting doubt on whether the forthcoming budget will deliver meaningful relief.