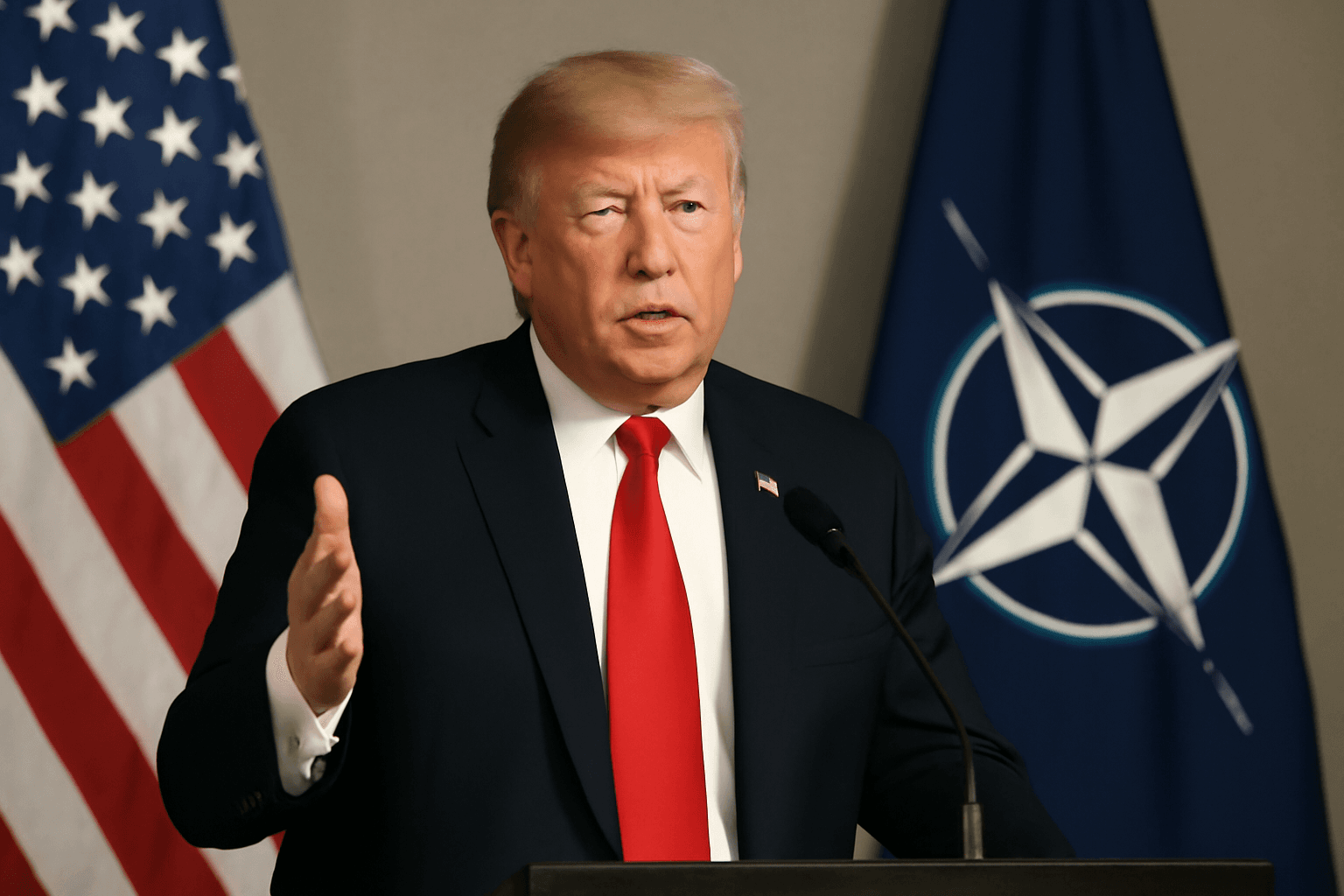

Understanding the Impact of Trump’s Tariffs on Inflation

Since the inception of President Donald Trump’s tariff policies, many economists predicted a surge in inflation due to the added costs on imported goods. However, recent analysis from the White House suggests otherwise, painting a more nuanced picture influenced by consumer behavior and national sentiment.

White House Economic Advisor Highlights “Patriotism” as a Key Factor

Kevin Hassett, the National Economic Council Director and a White House economic advisor, recently offered insights on CNBC’s Squawk Box about why tariffs haven’t translated into higher inflation. He emphasized the presence of strong consumer preference for American-made products, which he attributes to President Trump's leadership.

“There's, I think, a lot of patriotism in the data,” Hassett said, explaining that Americans have increasingly chosen domestic goods over imports, even when tariffs hike the costs on foreign products.

Hassett referenced a White House report showing that prices for imported goods actually dropped between December and May, defying expectations that tariffs would raise costs. He theorized that the combined effect of patriotic buying choices and improved perceptions of American-made products has softened the inflationary blow.

How Domestic Demand Dampens Inflationary Pressures

Experts have long warned that tariffs, by design, increase prices for consumers by making imported goods more expensive. Yet, Hassett contends the opposite dynamic is occurring—strong demand for U.S. products reduces reliance on imports.

- Americans perceive domestic products as higher quality and more beneficial to local communities.

- Reduced import demand counters the typical tariff-driven price rises.

- Trade deficit countries are reportedly absorbing tariff costs rather than American consumers.

This is an intriguing economic phenomenon—instead of tariffs acting simply as a tax passed on to consumers, shifts in consumer preference and import pricing strategies appear to be mediating the inflationary impact.

Critiques and Additional Economic Perspectives

Despite this optimistic outlook from the White House, the narrative is not without criticism and caveats:

- Some of Trump’s more aggressive tariffs have been delayed or rolled back, which may dampen immediate price pressures.

- Importers’ stockpiling prior to tariff enforcement could mask near-term effects on consumer prices, as goods were purchased before prices rose.

- Economists like Ted Gayer from Yale Budget Lab caution that the White House’s methodology might underestimate tariff impacts on import price indices, making data interpretation more complex.

- Harvard researchers have documented increases in prices of imported goods since tariffs hit certain trade partners like Canada, Mexico, and China.

What This Means for American Consumers and Policy

While tariffs are broadly expected to contribute to inflationary pressures this year, the interaction between policy, consumer behavior, and international trade responses complicates the picture. The notion that “patriotism” can influence economic outcomes highlights how cultural and emotional factors often underpin financial market dynamics.

From a policy perspective, this suggests that tariff impacts are not solely economic variables but also tied to national identity and consumer sentiment—a factor lawmakers and analysts should consider when crafting trade policies.

Editor’s Note: Navigating Tariffs, Consumer Behavior, and Inflation

Tariffs traditionally function as straightforward price hikes on imports, but the current data suggests a more intricate reality where patriotism and shifting consumer preferences play a significant role in cushioning inflation. This raises critical questions:

- To what extent can national pride sustain shifts in purchasing habits in the long term?

- Could tariffs inadvertently stimulate domestic industries more than previously believed?

- How reliable are official trade and price indices when factoring in strategic behaviors like stockpiling?

These dimensions underscore the importance of cross-disciplinary analysis—combining economics, psychology, and geopolitics—to fully comprehend trade policy ramifications.

As this debate continues, American consumers and policymakers alike would benefit from keeping a close eye on evolving data and be open to more than conventional economic wisdom when assessing tariffs’ true impact.