Trump’s Trade Deal With Japan Raises Eyebrows Over Altered Desk Notes

In a striking display of the unpredictable nature of international trade negotiations, President Donald Trump unveiled what he called a “massive” trade agreement with Japan on July 22, 2025. However, a closer look at the details—literally visible on a card placed on the president’s desk during a high-profile White House meeting—has sparked questions and raised eyebrows among analysts and watchers.

The Marked-Up Deal: What's Behind the Last-Minute Changes?

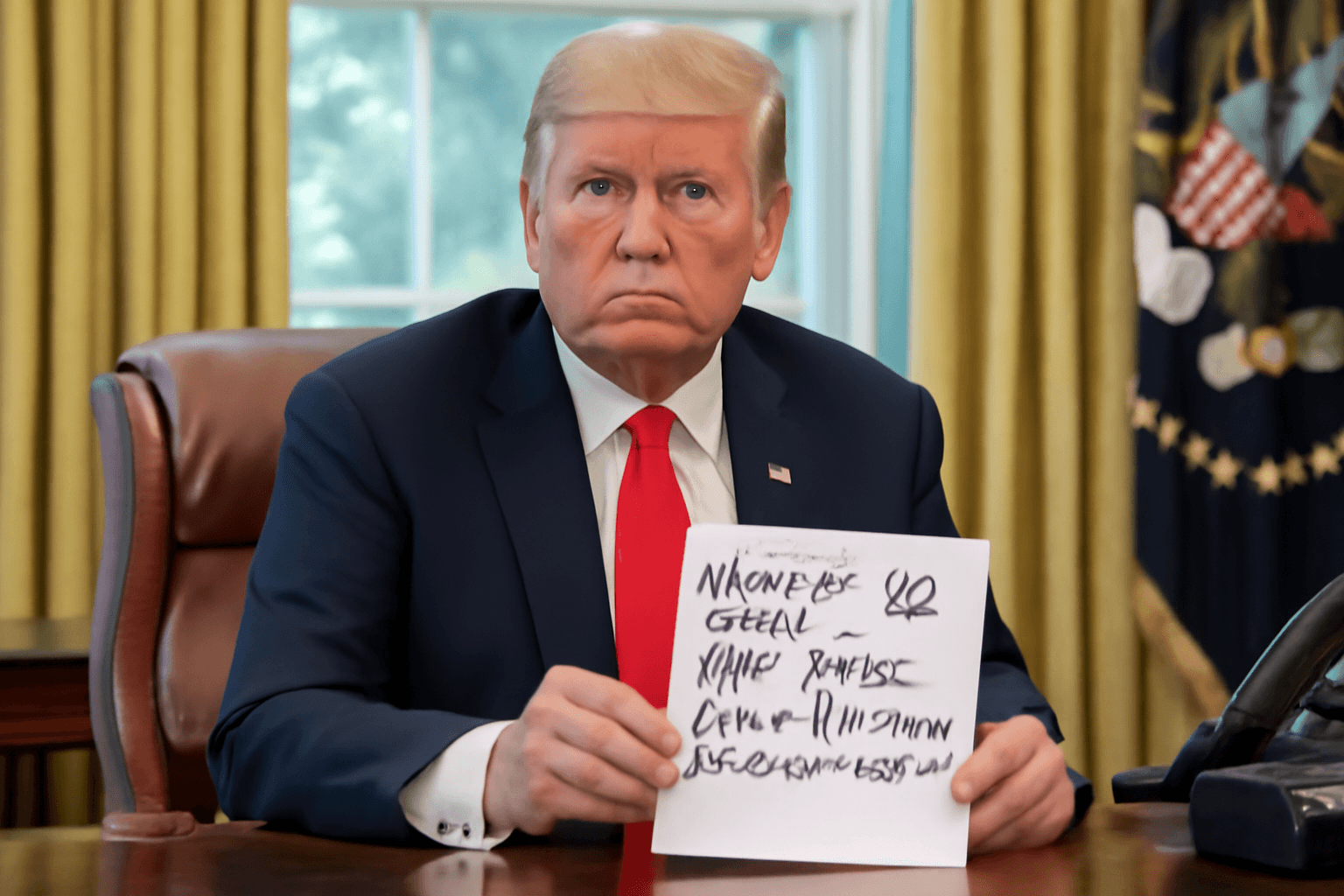

As Trump discussed the agreement with Japanese officials and top aides in the Oval Office, a photograph surfaced on X (formerly Twitter), posted by Dan Scavino, the White House deputy chief of staff. The image shows a card with key figures related to tariffs and investments, but notable discrepancies and handwritten edits stood out.

- Tariff Confusion: The card listed a 10% tariff, yet the automotive, pharmaceutical, and semiconductor sectors had a 15% rate noted. Meanwhile, Trump’s official post simply declared a flat “15% reciprocal tariff” on Japanese imports, without specifying sector-by-sector details.

- Investment Figures in Flux: On the card, the investment figure was initially $400 billion, then hand-altered to $500 billion. Yet Trump’s social media statement claimed Japan would invest a staggering $550 billion into the U.S., creating 90% profit returns and “hundreds of thousands” of jobs.

The source or rationale behind these last-minute number changes remains unclear, as the White House declined CNBC’s request for clarification. It’s uncertain whether these amendments were the result of late negotiating shifts, simple errors, or strategic messaging.

Inside the Deal: Perspectives from the Administration

Commerce Secretary Howard Lutnick briefly addressed the situation, claiming responsibility for the “big board” but deferring to Trump’s role as the chief dealmaker. Meanwhile, Treasury Secretary Scott Bessent shed light on the tariff approach, explaining Japan secured the 15% auto tariff rate because it agreed to provide robust equity credits and funding for major U.S. projects—a unique incentive other countries did not offer.

“They got the 15% rate because they were willing to provide this innovative financing mechanism,” Bessent noted.

Market and Expert Reactions: Between Skepticism and Strategy

Financial markets appeared uncertain about the full implications of the deal. Andy Laperriere, head of U.S. policy research at Piper Sandler, pointed out that Japanese officials perceive the $550 billion investment as a ceiling rather than a guaranteed minimum. He emphasized that some of these funds involve government-backed loan guarantees rather than outright investments.

Laperriere underscored the delicate political dynamics at play, suggesting Japan might “slow walk” certain investments that don’t align with their national economic interests, highlighting a potential gap between rhetoric and execution.

Broader Context: What This Means for U.S.-Japan Relations and Trade Policy

This episode isn’t just about numbers on a card; it reflects the complexities facing U.S. trade policy in a shifting global economic landscape. While the Trump administration has sought to project strength through bold trade agreements, the underlying details often reveal the intricacies of diplomacy, economic interests, and domestic political pressures.

From an American economic perspective, the promise of hundreds of thousands of new jobs and hefty Japanese investments is appealing. Yet, the ambiguity surrounding tariffs and investment commitments raises important questions about enforceability, transparency, and long-term benefits.

Moreover, the visible last-minute alterations intrigue policy analysts who emphasize the importance of clear, consistent messaging in international agreements, especially those with such significant economic implications.

What Remains Unanswered?

- Who made the handwritten edits on the card, and what was their official basis?

- How binding are the investment targets, and what mechanisms will enforce compliance?

- Will the 15% tariff be a new standard floor in U.S. trade negotiations with other partners?

- How will this deal impact American consumers and businesses in the affected sectors?

As trade remains a key pillar in U.S. foreign policy and economic strategy, stakeholders from lawmakers to investors will be watching closely to see how these headline numbers translate into real-world outcomes.

Editor’s Note

The unfolding story of the Trump administration’s trade deal with Japan highlights the delicate balancing act of leadership, negotiation, and communication in high-stakes international relations. The visible last-minute edits remind us that behind every bold political announcement lies a complex web of compromise and uncertainty. Readers are encouraged to track further developments and consider how trade agreements shape the economic future of both nations.