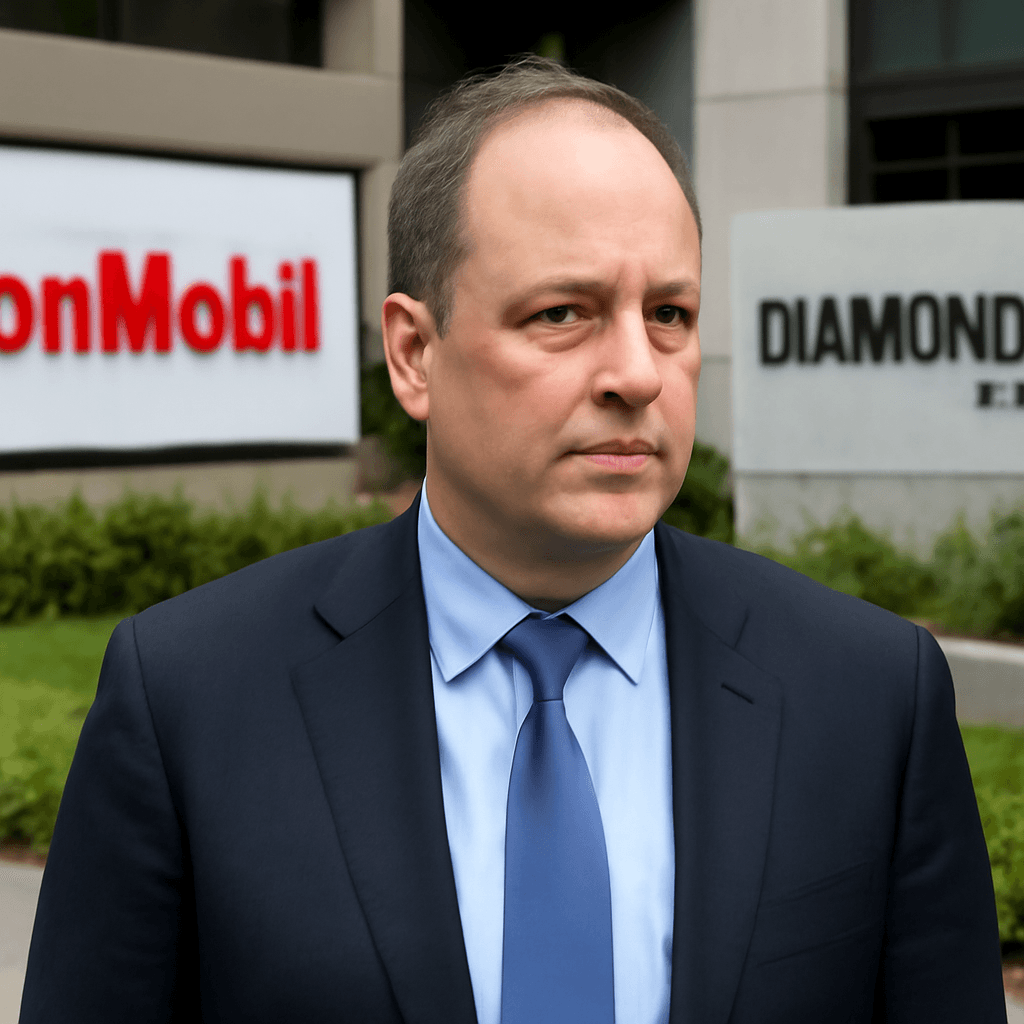

Why Danny Moses Is Betting on the Energy Sector Now

Danny Moses, famed for his prescient bets against mortgage-backed securities before the 2008 financial crisis, is turning his attention to a sector many investors have overlooked: energy. The founder of Moses Ventures recently shared his bullish outlook for energy stocks, highlighting their attractive valuation and improved fundamentals.

Energy Stocks Currently Underrepresented in the Market

At present, energy stocks make up just 3% of the S&P 500 index, well below their historical average of around 7%. Moses points out that this underweighting creates an opportunity. "I don't see that percentage dropping much further," he said, emphasizing a disconnect between the valuation of energy equities and underlying oil prices.

Over the past several years, the energy sector has undergone significant transformation, including mergers and acquisitions that have strengthened balance sheets and improved operational efficiency. This shift has made the sector more shareholder-friendly, with companies exercising disciplined capital spending rather than impulsive drilling expansion. "No one's being told to drill baby drill anymore," Moses noted, implying that energy firms are focusing on economically sound projects that bode well for investors.

Current Market Performance and Influences

Energy stocks have struggled this year, with the S&P 500 energy sector down roughly 3% compared to gains in broader markets. This weakness aligns with a decline in crude oil prices, particularly West Texas Intermediate (WTI), which has fallen about 9% year-to-date to near $65 per barrel. Contributing factors include increased supply from OPEC+ and concerns over demand outlooks globally.

Stocks to Watch: ExxonMobil and Diamondback Energy

Moses highlighted two names he favors in the energy space. First is ExxonMobil, which he described as a relatively undervalued stock that offers a solid growth rate, a reliable dividend, and ongoing share buybacks. Second is Diamondback Energy, another energy company noted for its financial discipline and shareholder returns. Moses sees both as strong candidates for investors seeking exposure to the resurgent energy sector.

In summary, despite recent headwinds, the energy sector’s improved fundamentals, alongside historically low market representation, make it an appealing area for investors looking to capitalize on potential upside. Danny Moses’s perspective underscores the shift in energy companies’ strategies toward sustainable growth and shareholder value.