Trump Administration’s New Venezuela Oil Deal Benefits Sanctioned Trader

Under the Trump administration, Chevron's operations in Venezuela were restructured with the stated goal of limiting the flow of money to the Nicolás Maduro regime. However, new data reveals a paradox: a U.S.-sanctioned businessman linked to Maduro’s inner circle has profited significantly from the revised deal, casting a shadow on Washington’s hardline stance against Venezuela’s authoritarian government.

Background: Chevron’s Troubled Venezuelan Venture

For years, the Biden administration faced Republican criticism for permitting Chevron to export Venezuelan crude oil, with opponents arguing this policy indirectly funded Maduro’s corrupt government. When Trump returned to office, he revoked the prior arrangement and altered the operational terms. Instead of making cash payments, Chevron was required to transfer part of the oil it produced directly to Venezuela’s state oil company PDVSA, which retains ownership of the oil fields.

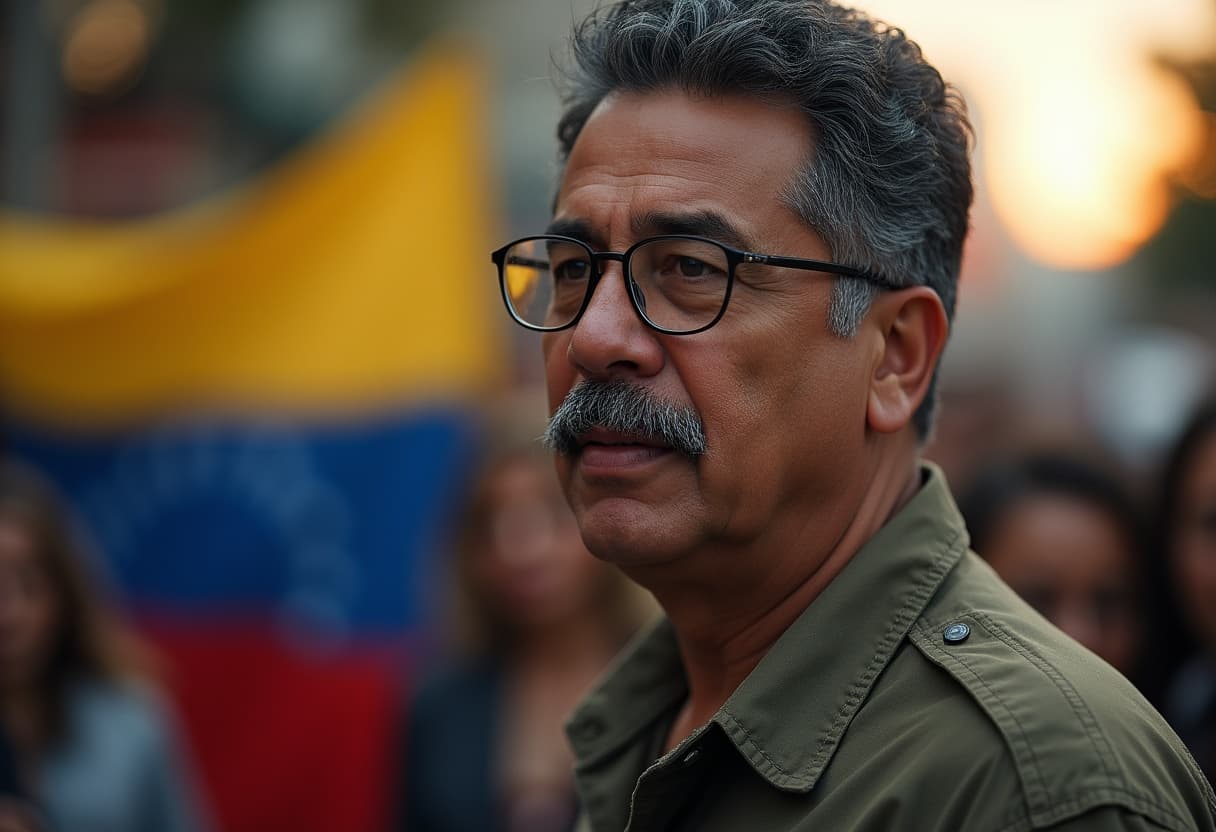

However, the new in-kind royalty payment system seems to have inadvertently empowered a businessman under U.S. sanctions: Ramón Carretero, a Panamanian oil trader linked to the Maduro family and sanctioned for benefiting the regime.

Data Exposes Financial Flows Favoring Sanctioned Entity

Exclusive internal data from PDVSA reveals that Carretero’s company, Shineful Energy, has handled the sale of all Venezuelan government oil from Chevron’s largest producing field, Petroboscán, since July 2025. The quantity amounts to nearly 11 million barrels, valued at approximately $500 million.

PDVSA assigns all oil sales from its share to Shineful Energy, without Chevron’s involvement in the sales process. Industry insiders describe complex export logistics, with Venezuelan oil primarily shipped to China through this trading firm. Crucially, the destination of proceeds remains murky, and Venezuelan formal economy data indicates a noticeable decline in hard currency inflows this year.

Trump Administration’s Latest Moves and Sanctions

Recognizing the problematic financial gains accruing to Maduro’s associates, the Trump administration announced intensified restrictions. On December 16, 2025, a sanctions action targeted Carretero and companies linked to him, accusing them of operating on behalf of the Venezuelan government and partnering closely with the Maduro-Flores clan.

Furthermore, President Trump imposed a sweeping prohibition on sanctioned oil tankers involved in Venezuelan trade, aiming to choke off illicit profits. The complexities expose the tension between the administration's declared goal of isolating Maduro and its concurrent willingness to maintain U.S. corporate presence in Venezuela’s lucrative energy sector.

Chevron’s Balancing Act Amidst Contradictory Policies

Chevron reportedly produces about 240,000 barrels per day in Venezuela, constituting over one-fifth of the country’s total output. Under the Biden administration’s earlier license, Chevron had directed proceeds through designated private Venezuelan banks intended to benefit local businesses and support economic recovery outside government control.

Trump’s policy shift redirected royalties as in-kind oil deliveries to PDVSA, arguably strengthening official channels. This arrangement has sparked debate among lawmakers and experts:

- Republican View: Supporters, including Florida Representative Mario Díaz-Balart, hail Trump’s tougher stance as a principled denial of Venezuelan government funding.

- Democratic Critique: Former Representative Debbie Mucarsel-Powell warns that enabling PDVSA to receive direct payments without strict oversight merely props up Maduro’s regime financially.

Chevron maintains that its operations comply fully with U.S. laws and sanctions frameworks, emphasizing adherence to licensing conditions.

US-Venezuela Oil Relations: A Complex Geopolitical Puzzle

The story illustrates how geopolitical ambitions, corporate interests, and sanctions policies intertwine in complex ways. While the Trump administration enacted aggressive sanctions to isolate Maduro, it also continued to permit Chevron’s presence, aiming to retain American influence in a resource-rich nation.

Meanwhile, sanctioned actors appear to exploit regulatory loopholes, raising questions about the effectiveness and enforcement of U.S. sanctions programs.

Key Questions Moving Forward

- How can U.S. sanctions regimes better prevent sanctioned individuals from profiting indirectly through state-owned enterprises?

- What is the impact on Venezuelan citizens when oil revenues continue to flow to regime-linked traders?

- To what extent do commercial interests in companies like Chevron shape U.S. policy in authoritarian states?

Conclusion: Navigating Between Sanctions and Strategy

The Chevron-Venezuela saga underlines the challenges in balancing strict sanctions enforcement with strategic engagement. As U.S. policymakers aim to undermine authoritarian regimes like Maduro’s, they must carefully assess how evolving deals influence real outcomes on the ground, including who ultimately benefits financially.