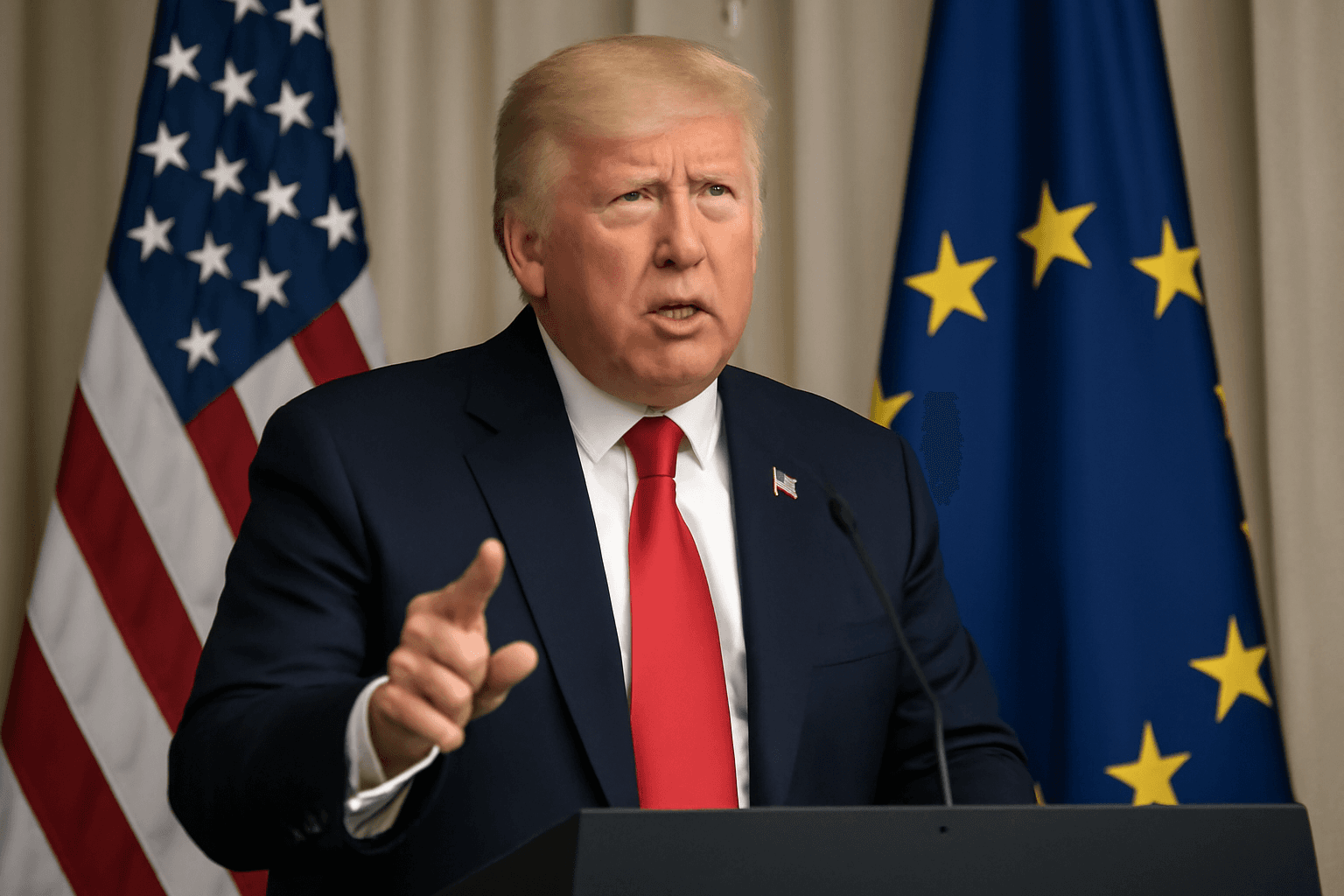

Wall Street Flags Risks as US Threatens 30% Tariffs on EU Imports

In a surprise move that rattled financial markets, U.S. President Donald Trump announced a looming threat to impose a 30% tariff on European Union goods, escalating fears over the fragile state of Europe's economy. This unexpected development sent shockwaves through Wall Street and beyond, prompting leading investment banks to warn of a potential prolonged and deeper economic downturn across the continent — one that could compel the European Central Bank (ECB) to reconsider its monetary policy and potentially cut interest rates.

The Surprise Announcement and Its Ripple Effects

Trump’s threat, communicated via letters posted on his Truth Social platform addressed to European Commission President Ursula von der Leyen, signaled a steep tariff hike that goes beyond prior negotiations. Furthermore, he warned that should the EU retaliate with additional tariffs, the U.S. would stack those on top of the 30% levy, creating a dangerous tariff spiral.

Goldman Sachs described the announcement as a "surprise" that "reignited concerns around the Euro area outlook," especially after months of cautiously optimistic, constructive trade discussions that seemed to be steering towards de-escalation.

Economic Forecasts Point to Real Risks

Goldman Sachs’ chief European economist, Sven Jari Stehn, shared a cautiously hopeful perspective, noting the possibility that Trump's aggressive stance might be a strategic negotiation tactic. Goldman’s baseline still envisions a "framework agreement" preserving current tariffs — 10% on all goods, and higher rates on steel, aluminum, and autos.

Yet, their economic modeling is clear: if a sustained 30% tariff comes into force, the eurozone's GDP could shrink cumulatively by around 1.2% by 2026. That is a significant hit for an economy already grappling with geopolitical uncertainty and inflation pressures.

Barclays Echoes Concerns: Deeper Contraction Likely

Analysts at Barclays reinforce the worry, projecting a sharper near-term contraction that could slice an additional 0.7 percentage points from eurozone GDP growth. Silvia Ardagna, Barclays’ chief European economist, pointed out the compounding effects: the euro’s recent appreciation and the spillover impact on global growth from the U.S. tariff strategy will exacerbate the strain.

This downturn is expected to be disinflationary, complicating the ECB's task. Barclays predicts inflation could fall well below the ECB’s 2% target and linger there, increasing the likelihood that the ECB will need to cut rates, possibly down to 1% by early 2026.

Monetary Policy: ECB Caught Between Inflation and Growth Risks

Both Goldman Sachs and Barclays forecast an environment where the ECB is squeezed between slowing growth and waning inflation. Goldman Sachs believes the ECB might maintain rates at 2% this July if a favorable trade deal is struck but anticipates deeper cuts if tariffs hit 30%. Their forecast underscores a probable slight undershoot in core inflation by 2026, propelled by a stronger euro and tariff pressures.

Currency Movements and Fiscal Stimulus: A Double-Edged Sword

Interestingly, Goldman Sachs expects the euro to strengthen against the dollar, pushing the EUR/USD rate to about 1.25 over the next year. This forecast leans on an anticipated robust German fiscal stimulus package combined with a potentially weakening dollar.

While a stronger euro can dampen inflation by making imports cheaper, it also weighs on export competitiveness, potentially compounding growth challenges amid tariff disputes.

EU Officials Express Optimism Amid Tensions

Despite the harsh rhetoric, EU Trade Commissioner Maros Sefcovic struck a cautiously optimistic tone, suggesting a solution remains within reach. Ahead of a crucial EU trade ministers’ meeting in Brussels, Sefcovic remarked, "The feeling on our side was that we are very close to an agreement." This diplomatic nuance suggests both sides may yet avoid a costly trade war.

Expert Perspectives: Is This All Just a Negotiation Ploy?

Economists at Berenberg similarly view the tariff threats as part of an ongoing bargaining chess game, albeit with elevated stakes. Economist Salomon Fiedler pointed out, "While Trump has made extreme tariff threats before and reversed course, this latest threat was fiercer than expected. We now see higher risks skewed towards elevated tariffs, but the delayed implementation date indicates he’s still angling for negotiation."

Why This Matters: Broader Implications for the Global Economy

The looming tariff conflict arrives at a delicate time for Europe's recovery and the global trade environment. Import restrictions of this scale threaten to:

- Disrupt deeply integrated transatlantic supply chains.

- Weaken investor confidence amid already fragile global growth prospects.

- Pressure central banks worldwide into policy shifts that could destabilize markets.

- Fuel protectionism, inspiring similar retaliatory measures beyond the EU-US axis.

For American policymakers and businesses, escalating trade tensions with the EU — one of the U.S.'s largest trading partners — pose risks to consumer prices, manufacturing costs, and diplomatic ties that have historically underpinned economic and security cooperation.

Editor’s Note: Navigating the Crossroads of Trade and Economy

As the clock ticks toward the August tariff deadline, markets and policymakers are caught in a precarious balancing act. This episode brings into sharp focus the fragility of global trade networks and the profound economic fallout that aggressive unilateral measures can unleash. It also raises pressing questions: Will both sides prioritize strategic diplomacy over brinkmanship? How prepared is the ECB to maneuver through yet another storm amid already tight inflation and growth dynamics? And crucially, what message does this send about the future of global economic collaboration in an increasingly fragmented world?

Watch closely as this ongoing saga unfolds, since its implications will reverberate far beyond Wall Street and Brussels, touching the lives of millions on both sides of the Atlantic.