Markets Shake Off July Jobs Report Amid Tariff Hikes and Tech Surge

Despite the U.S. Bureau of Labor Statistics' sharp downward revision to prior job numbers — which President Donald Trump criticized as "RIGGED" and "CONCOCTED" — U.S. stock markets showed resilience on Monday, bouncing back from Friday’s selloff. This rebound reflects a mix of investor instinct and broader market dynamics rather than a clear directional signal, underlining the complex interplay between economic data, political rhetoric, and global trade tensions.

U.S. Stocks Experience a Post-Report Bounce

Sam Stovall, Chief Investment Strategist at CFRA Research, describes Monday’s uptick as a classic market rebound after a steep drop. He cautions investors to remain vigilant, anticipating possible profit-taking rallies as the week unfolds. "Stocks tend to pop after a drop, so that's what's happening," Stovall noted, adding that some traders might soon pause to reassess recent gains in light of the ongoing economic uncertainties.

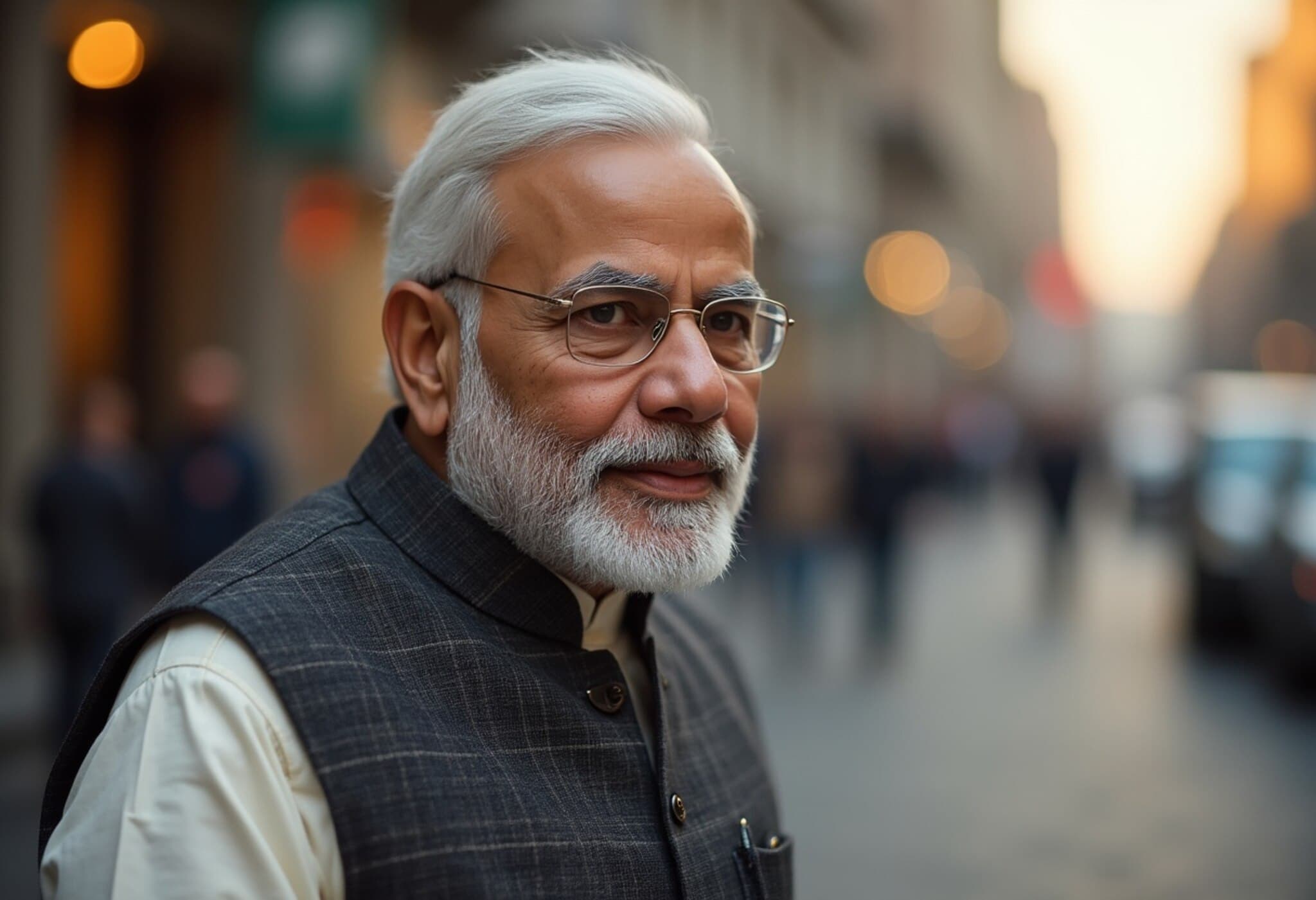

Trump’s Tariff Escalation Targets India

In a move that further complicates an already fraught trade landscape, President Trump announced plans to substantially increase tariffs on Indian imports, effective August 7. This escalation stems from mounting geopolitical and trade disagreements between the U.S. and India, with India responding by accusing the U.S. and European Union of unfairly targeting its economy. The South Asian nation’s concerns spotlight the increasingly fraught balance between protecting domestic industries and maintaining productive international partnerships.

European Union Delays Tariffs on the U.S., Opening Dialogue

Amid mounting trade tensions, the European Union has opted to suspend its planned tariffs on U.S. goods for six months, deferring measures originally slated to begin in early August. This pause allows for renewed negotiations aimed at finalizing a Joint Statement to resolve ongoing disputes and avoid further economic disruption. The EU’s move reflects a strategic attempt to balance punitive actions with the benefits of sustained transatlantic cooperation.

Asian and U.S. Markets: Divergent Trends

Following the weekend’s tariff announcements, Asian markets displayed a mixed reaction. While U.S. indices like the S&P 500 and Nasdaq Composite rebounded robustly, the Indian Nifty 50 slipped as trading opened Tuesday, echoing investor concerns about the new tariff impositions. This divergence underscores the interconnected but often uneven impacts of global trade policies on regional markets.

Palantir Surpasses Revenue Expectations, Highlighting Tech Sector Strength

Wall Street was pleasantly surprised as Palantir Technologies reported quarterly revenue exceeding $1 billion for the first time, achieving this milestone earlier than anticipated. The surge is emblematic of a broader tech sector momentum, with the so-called "Magnificent Seven" — leading tech giants driving much of the market’s gains — posting a remarkable year-over-year earnings growth of 26%. In stark contrast, the remaining companies within the S&P 500 collectively saw only a 4% rise, which experts warn may signal overconcentration risks in the equity market.

SEC’s Potential Crackdown on Foreign Listings Raises Market Questions

In parallel regulatory developments, the U.S. Securities and Exchange Commission is formulating proposals to tighten the oversight of foreign companies listed on U.S. exchanges. Foremost among the considerations is redefining the criteria for "Foreign Private Issuers" to require active listings on major international exchanges for eligibility to certain regulatory exemptions. This proposal, aimed at bolstering market transparency and investor protection, could prompt a wave of foreign firms to pursue secondary listings in financial hubs like London, reshaping the global capital markets landscape.

Expert Analysis: Navigating Trade Frictions Amid Market Volatility

The latest tariff adjustments and regulatory shifts highlight persistent geopolitical tensions affecting global markets. For investors and policymakers alike, the challenge lies in discerning transient market reactions from fundamental economic trends. The paradox of strong tech earnings against a backdrop of uneven economic data and rising protectionism prompts critical reflection on sustainability and risk distribution in equity portfolios.

- Tariff impacts: The timing of tariff hikes and market rebounds may create windows for strategic profit-taking but also risks volatility from uncertain policy outcomes.

- Tech sector concentration: Heavy reliance on a handful of tech giants for market growth raises questions about longer-term valuation risks and the breadth of U.S. economic recovery.

- Regulatory shifts: SEC proposals could have a ripple effect on global capital flows, emphasizing the need for international cooperation on financial governance.

Editor’s Note

While headline economic indicators seem to stir political controversy, the markets’ ability to shrug off shocks is both a testament to investor resilience and a warning of potential complacency. With new tariffs poised to reshape trade relationships, coupled with uneven earnings performance across sectors, investors must maintain a discerning eye on policy developments and market fundamentals alike. The evolving framework for foreign listings on U.S. exchanges adds another layer of complexity, posing questions about the future shape of global marketplaces. This dynamic mix calls for nuanced strategies and ongoing vigilance from market participants.